Financial Hygiene for Remote Contractors

When I started working remotely full-time, my finances felt like a set of juggling balls: taxes in one hand, invoices in the other, and somewhere in between, a random Spotify subscription I forgot to cancel. If you’re a remote contractor, especially one who moves around or juggles multiple clients, your financial life can get messy fast.

The good news is, financial hygiene isn’t about becoming an overnight accounting wizard or tracking every penny. It’s about building simple, sustainable habits that give you more freedom and fewer surprises — all in less time than it takes to order a coffee. Here’s how I keep my own financial circus under control, without turning into a spreadsheet hermit.

Why Remote Contractors Need a Different Playbook

Traditional employment comes with perks — steady paycheck, automatic tax withholding, benefits — but as a remote contractor, you have to build those systems yourself. Here’s what makes it trickier:

- Irregular income: Payments might come weekly, monthly, or at random hours of the night. Feast, famine, or both at once.

- No built-in tax withholding: You’re the boss, and the tax man never forgets.

- Subscriptions everywhere: Tools, SaaS, cloud storage, VPNs… they add up fast (and often renew when you least expect).

- Currency conversions: If you work with international clients, even a stable month can look wild on your bank statement.

Been there, panicked at tax time, bought the t-shirt.

My “Oh, Crap” Moment: The Year I Owed $7,400

Let’s get real. My first year as a remote contractor, I didn’t track income or set aside taxes. I figured, “I’ll deal with it later.” Later came in April, with a tax bill that could’ve paid for a used Honda Civic.

I spent a weekend stress-eating bagels and searching “how to file taxes as a contractor” at 2 a.m. Not recommended.

Lesson learned: Financial hygiene is about staying one step ahead, not catching up in panic mode.

The 15-Minute Financial Hygiene Routine

You don’t need to overhaul your life. These steps can fit into a coffee break — and they’ll save you hours (and headaches) later.

1. Separate Your Accounts

Open a dedicated business checking account. Even if you’re a solo act, this keeps client payments, business expenses, and taxes from mixing with your personal pizza budget. It also makes tax time way easier.

How to Do It:

- Pick a bank with good online tools (e.g., Mercury or Bluevine in the US).

- Transfer your next client payment directly here.

2. Automate Your Tax Savings

Rule of thumb: Set aside 25-30% of every payment for taxes. Pretend it’s not yours.

- Set up an automatic transfer to a high-yield savings account every time you get paid.

- Label it “Do Not Touch (Taxes).”

*If you’re dealing with multiple currencies, check if your bank allows sub-accounts or “buckets” to keep things tidy.*

3. Get Ruthless with Subscriptions

Remote work means you probably have more digital subscriptions than you realize. You don’t have to go full minimalist, but you should know what you’re paying for.

- List every monthly or annual subscription (tools, domains, software, etc).

- Cancel anything you haven’t used in 60 days (seriously).

- Set a calendar reminder to review subscriptions every quarter.

Tools like Rocket Money (formerly Truebill) or Bobby can help track and manage subs in one dashboard.

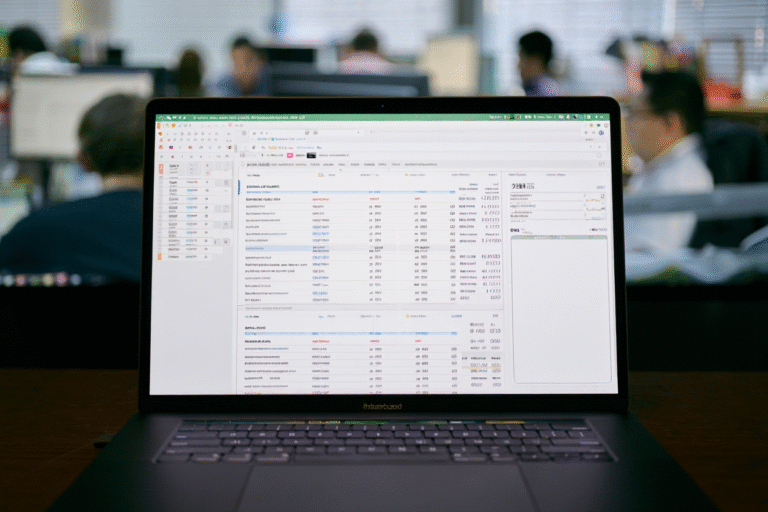

4. Track Income & Expenses (Without Losing Your Mind)

You don’t need to log every coffee, but you do need a record of client payments and business expenses. This makes taxes (and budgeting) much less scary.

What I use:

- Wave (free, easy invoicing, tracks payments)

- YNAB (for budgeting, not just business)

- Google Sheets (if you like to roll your own — I did this for years)

Pick something you’ll actually use. The best system is the one you stick with.

Financial Hygiene Checklist for Remote Contractors

| Task | When | Tools |

|---|---|---|

| Open a separate business account | One-time | Mercury, Bluevine, Wise |

| Automate tax savings (25-30%) | Every payment | Your bank, Ally, Capital One 360 |

| Review & cancel subscriptions | Quarterly | Rocket Money, Bobby, manual review |

| Track income & expenses | Monthly | Wave, YNAB, Google Sheets |

| Invoice clients promptly | After work delivered | Wave, Bonsai, AND.CO |

| Send estimated tax payments | Quarterly (US) | IRS Direct Pay, Wise (if international) |

| Review currency conversion fees | Annually | Wise, Revolut, Payoneer |

Toolbox: My Go-To Links

- Wave – Free invoicing, payments, and accounting

- You Need A Budget (YNAB) – Budgeting for real people

- Mercury – Online business banking for US-based contractors

- Wise – Low-fee international transfers and multi-currency accounts

- Rocket Money – Subscription tracking and management

- IRS Direct Pay – For US estimated tax payments

- Bobby – Simple subscription tracker (iOS)

- Revolut – Multi-currency account for global workers

Quick Wins: What You Can Do in 15 Minutes Today

- Log into your bank and open a new checking or savings account just for business or tax savings.

- Make a quick list of every subscription you pay for (look at your last month’s statement).

- Choose one tool (Wave, YNAB, Google Sheet) to track your next client invoice and payment.

- Set a calendar reminder for tax deadlines (quarterly if you’re in the US).

Small, consistent action beats a once-a-year scramble. Your future self will thank you.

Keep It Simple, Keep Moving

You don’t have to be perfect. I still miss an occasional receipt or let a subscription slip through the cracks. But with a few habits and the right tools, you can avoid the big messes and keep your financial life (mostly) drama-free. That means more time for the work you love, and less time untangling your bank statements.

Some links in this post may be affiliate links. You’ll pay the same price, but if you sign up through them, I may earn a small commission — which helps support this blog and my coffee habit. Thanks!